Social Security is a solid base upon which fortunate workers have been able to build. It is unquestionably the most important source of retirement income for the nation’s working families, even those fortunate to have other assets.

Though the wealthiest among us may not recognize Social Security’s importance to them, they might be enlightened by the cautionary tale of Neil Friedman, a millionaire who invested his entire fortune with Bernie Madoff. When Madoff’s Ponzi scheme was revealed, Friedman and his wife found themselves forced to survive on their Social Security and money they could earn selling note cards emblazoned with photos of their former lavish vacations. Moreover, the Friedmans were not the only Madoff victims left destitute.

Like those Madoff victims, about one out of three retirees depend on Social Security for virtually all of their income. Around two out of three retirees depend on Social Security for the majority of their income.

As important as Social Security is for virtually all of us,it is especially important to women, people of color, those who are LGBTQ, and others who have been disadvantaged in the workplace. Those groups are less likely to have jobs with employer-sponsored pensions. On average, they have lower earnings and therefore less ability to save. They are more likely to have health problems and physically demanding jobs that force early retirement. Also, they are more likely to have periods of unemployment or take time out of the paid work force to work as family caregivers. Moreover, because women and Hispanics have, on average, longer life expectancies, they have even greater need of Social Security’s guaranteed benefits that last until death.

Almost one out of two divorced, widowed or never-married female beneficiaries aged 65 and older rely on Social Security for virtually all of their income (46 percent in 2016).More than one out of two unmarried African American beneficiaries aged 65 and older rely on Social Security for virtually all of their income (55 percent in 2016). For Hispanic Americans the percentage is even higher. Nearly six out of ten unmarried Hispanic beneficiaries aged 65 and olderrely on Social Security for virtually all of their income (58 percent in 2016).

African Americans and Hispanics disproportionately qualify for Social Security disability and survivor benefits, as do their children. African American children constitute 14 percent of all American children, but 22 percent of the children receiving benefits as the result of a parent with a disability and 21 percent of the children receiving benefits as the result of the death of a parent.

Social Security is the Nation’s Most Universal, Efficient, Secure, and Fair Source of Retirement Income

Social Security’s importance and success derive from its essential purpose and ingenious design. It is insurance against the loss of earnings in the event of old age, disability, or death. Insurance is most cost-efficient and reliable when the risks can be spread across as broad a population as possible and when no one can purchase the insurance when personal risk factors increase – a practice known as adverse selection. The only entity that has the power and ability to establish a nationwide risk pool that covers all workers at the moment they start work and, in that way, avoids adverse selection is the federal government. It is the only institution that can make the insurance mandatory and universal.

Social Security is, of course, mandatory and nearly universal. Nearly nine out of ten seniors receive Social Security retirement benefits. Around 175 million workers contribute to Social Security.

For the same reasons, Social Security is extremely efficient. Moreover, when the federal government administers the insurance, overhead is minimized. Instead of high-paid CEOs, hardworking civil servants are in charge, and other costs, like advertising and marketing, are unnecessary. Consistent with that predictable efficiency, less than a penny of every Social Security dollar is spent on administration. The rest – more than 99 cents of every dollar – is paid in benefits. That extremely low administrative expense is unachievable by employer-sponsored retirement plans or private insurance.

Social Security has other attributes that add to its value and importance. Like employer-sponsored defined benefit plans, its benefits are pegged to final pay. That is important because replacing final pay in order to maintain one’s standard of living in retirement is the goal. Also like employer-sponsored defined benefit plans, Social Security benefits are paid in the form of joint and survivor annuities. Consequently, they last until death, in contrast to savings, which can be outlived.

In addition, Social Security’s guaranteed benefits are extremely secure. They are much more secure than retirement savings, which can be lost as the result of a market downturn or simply poor or unlucky investment decisions. They are also much more secure than employer-sponsored traditional pensions and much more secure, as well,than the life insurance, disability insurance, and retirement annuities sold by private insurance companies. Unlike private sector retirement plans and insurance products, Social Security is sponsored by the federal government, which is permanent, and so will not go out of business. It has the power to tax and issue bonds backed by the full faith and credit of the nation. Furthermore,all risks are spread nationwide, not concentrated on single employers,insurance companies, or worse, individual workers.

Moreover, unlike savings, the benefits are only available when an insured event occurs and cannot be withdrawn to meet more immediate needs. Contributors understand that the benefits are only payable as a result of disability, death, or old age. They do not expect or seek early withdrawals or lump-sum payouts. In addition, the benefits are protected from private-sector creditors. Consequently, they are efficiently targeted, certain to be paid only in old age or when an insured worker becomes disabled or dies.

In contrast to employer-sponsored defined benefit plans, Social Security is completely portable from job to job. Consequently, it is as good for mobile workers as it is for workers who remain with one employer.

Also, Social Security imposes fewer administrative costs on employers. It is carried from job to job; records are kept seamlessly by the Social Security Administration through the use of Social Security numbers. Wages from all covered employment are automatically recorded by the Social Security Administration and used in the calculation of benefits. Employers are free from the record-keeping,reporting, and fiduciary requirements of their own sponsored plans.

Of course, Social Security provides for more than retirement. Its benefits are payable in the event of disability, if that occurs prior to retirement, and in the event of death, if there are eligible survivors. Indeed, as a result of these provisions, Social Security is the nation’s largest children’s program.

Furthermore,Social Security includes features that are not found in private sector alternatives. For example, private sector annuities and defined benefit pensions reduce the annuity amount of the primary insured, if a spouse is added. In contrast, Social Security’s annuities automatically include add-on benefits for the joint and survivor portion of the annuity without reducing by a penny the life annuity portion paid to married workers.

If the worker has been divorced after having been married ten years, there are add-on spouse and widow(er) benefits for every ex-spouse. Again, those add-on benefits don’t reduce the worker’s retirement, disability, and family benefits by a penny. Importantly, those divorced spouse and widow(er) benefits are the ex-spouse’s as a matter of right. The parties to the divorce are spared the burden of having to negotiate or go to court to secure their benefits.

Similarly, the benefits Social Security provides to children when adults supporting them lose wages as the result of death, disability, or old age, are, like spousal and widow(er) benefits, add-on benefits that do not reduce by even a penny the primary insured’s benefits.

Importantly, all benefits are annually increased to offset the effects of inflation. Social Security provides inflation protection without limit, regardless of the rate of that inflation. Consequently, unlike traditional private pension benefits which erode over time, Social Security maintains its purchasing power. (It should be noted that the measure of inflation is in need of updating to make it more accurately reflect the costs of beneficiaries, but, even so, the availability of uncapped inflation protection is one of Social Security’s most valuable attributes.)

Social Security’s One Shortcoming is that its Benefits are Too Low

As vital and well-designed as they are, Social Security’s benefits are extremely modest by virtually any measure. In absolute terms, the average monthly Social Security benefit in December 2018 was $1,342, or $16,104, on an annualized basis. That is below the 2019 official federal poverty level for a two-person household, and substantially below the amount needed to satisfy the Elder Economic Security Standard Index, a sophisticated measure of the income necessary to meet bare necessities.

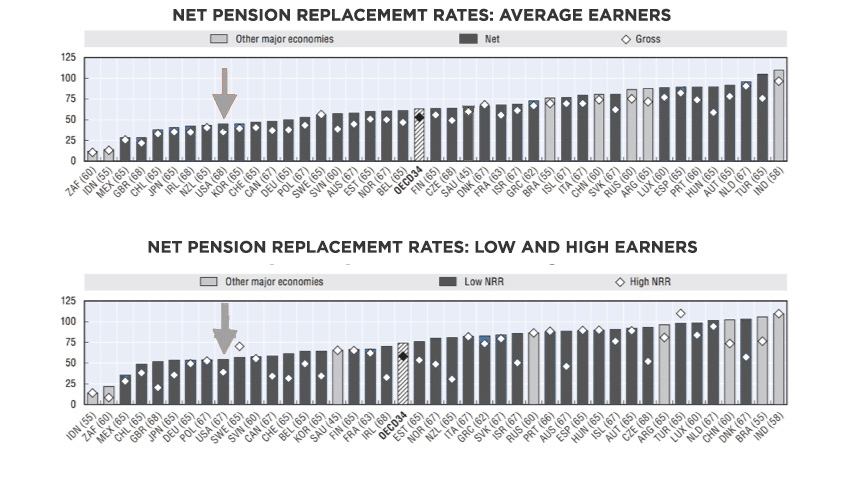

Social Security’s benefits are also extremely low compared to the retirement benefits of other industrialized nations,as the following chart reveals. (The bars designating U.S. benefits are highlighted with arrows.)

As informative as are Social Security’s absolute benefit levels and its levels compared to other nations’ benefits, the most important measure of the inadequacy of Social Security’s benefits is what proportion of pay is replaced, since replacing lost wages is the goal of the program.

Experts estimate that workers and their families need about 70 to 80 percent of pre-retirement pay to maintain their standards of living. Those with lower incomes need higher percentages; those more affluent, with more discretionary income and other assets, need somewhat less.

While Social Security appropriately replaces a larger proportion of pre-retirement pay of workers who have lower wages, it does not come close to providing sufficient income to meet the goal of maintaining standards of living in retirement. Workers earning around $50,000, who retired at age 62 in 2018, received only 32 percent of their pay or about $16,000 a year. Lower-income workers, earning around $22,500, received around 43 percent of their pay, but that is only about $9,700 a year.

Previous: How Social Security transformed America by making independent retirement a reality

Next: Four things Congress shouldn’t do (and one it must remember) about Social Security

Excerpted from testimony given by Nancy Altman, President of Social Security Works, at the February 6, 2019 hearing of the U.S. House Ways and Means Committee on improving retirement security for America’s workers.