Numerous polls and surveys over recent years reveal that worry about not having enough money in retirement leads the list of Americans’ top financial concerns. A Gallup poll conducted last May, for example, reported that nearly six out of ten Americans – 58 percent – were very or moderately concerned about “Not having enough money in retirement.” That topped six other financial challenges, including “Not having enough money to pay for your children’s college” and “Not being able to pay your rent, mortgage or other housing costs,” and tied with “Not being able to pay medical costs in the event of a serious illness or accident.”

Expert analyses make clear that Americans’ concerns about retirement are well founded. The Center for Retirement Research at Boston College (“CRR”), for example, has, for a number of years, calculated a National Retirement Risk Index. Its most recent analysis found that one out of two working-age households will be unable to maintain their standards of living in retirement even if they work until age 65, take out a reverse mortgage on their homes and annuitize all of their other assets. CRR has found that the number of “at risk” working-age households increases to over 60 percent when health care costs are taken into account.

The reasons for our retirement income crisis are clear. Traditional employer-sponsored defined benefits are disappearing. In 1980, around 38 percent of workers participated in defined benefit plans; in 2017,only 15 percent did. Many employers have replaced traditional defined benefit plans with 401(k) plans, but those have proven inadequate for all but the very wealthiest.

As a result of these developments, future retirees are likely to rely on Social Security for even more of their retirement income. However, as reliance is growing, the Social Security foundation is gradually weakening.

Raising the retirement age will make the crisis worse

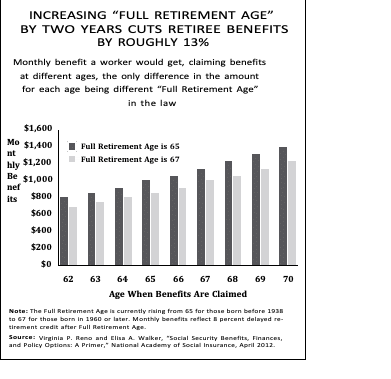

As inadequate as the percentages of pre retirement earnings that Social Security replaces are today, they will be lower in the future as the result of current law. In 1983, Congress passed legislation that raises Social Security’s full retirement age from age 65 to 67, a change that is still being phased in.(It will be fully phased in for those born after 1959.)

It is facile – but wrong – to think that if the retirement age is increased and you work longer, you will catch up. For those not thoroughly immersed in how Social Security benefits are calculated, increasing Social Security’s “full” retirement age may sound like just a small, reasonable adjustment for changes in life expectancy. But that is incorrect.

Raising Social Security’s statutorily-defined“retirement age” by a single year is mathematically indistinguishable from about a 6 to 7 percent across-the-board cut in retirement benefits, whether one retires at age 62, 67, 70, or any age in between. If the definition of “retirement age” is changed to be an older age, you always get less than you would have without the change, as the chart below illustrates.

Cutting benefits by raising the statutory retirement age is especially hard on low-wage workers (disproportionately people of color) who are more likely to work in physically demanding jobs, as well as on workers (disproportionately women) who must retire early to care for aged parents or other family members.

In addition to understanding that raising the statutory retirement age is identical to an across-the-board benefit cut because of the manner in which benefits are calculated, it is also important to recognize that those urging this particular form of cut have exaggerated the gains in longevity and ignored the fact that those gains have not been equally distributed.

Although people, on average, are living somewhat longer today, the increase is not the decades that some claim. Moreover, in the last three years, life expectancy from birth in the United States has declined. Furthermore, these are average increases across the population. The gap between the life expectancies of higher-income and lower-income Americans is growing.

Those who want to cut Social Security by increasing the statutorily-defined “retirement age” focus on increased average longevity to push the simplistic belief that an aging population makes Social Security unaffordable. The population is indeed aging, but that is primarily because birth rates are low, not because of rapidly increasing life expectancies, according to the Chief Actuary of the Social Security Administration.

It is important to recognize not only that the population is aging but also to understand the reason why. Because it is caused by lower birth rates, increased immigration is an obvious solution. Because immigrants to the United States tend to be younger and may,as a matter of culture, have larger families, they increase the ratio of working age population to retirement age population in much the same way as higher fertility rates do.

In Congressional testimony, the Chief Actuary of the Social Security Administration explained the benefit to Social Security of increased immigration:

“Immigration has played a fundamental role in the growth and evolution of the U.S. population and will continue to do so in the future. In the 2014 Trustees Report to Congress, we projected that net annual immigration will add about 1 million people annually to our population. With the number of annual births at about 4 million, the net immigration will have a substantial effect on population growth and on the age distribution of the population. Without this net immigration, the effects of the drop in birth rates after 1965 would be much more severe for the finances of Social Security, Medicare, and for retirement plans in general.”

Raising Social Security’s statutorily-defined “retirement age” will substantially weaken the retirement security even of workers who can and want to remain in the work force: Despite the existence of the Age Discrimination in Employment Act, older workers have a much harder time finding new work after being laid off. With no job prospects, they may find themselves with no choice but to claim permanently reduced early retirement benefits at age 62, even if they wish to work longer.

The nation is now in the middle of seeing the full retirement age rise to 67 — a 13 percent across-the-board benefit cut. It would be the height of irresponsibility to contemplate more changes in the same direction before the current benefit cut is fully phased in, and its impact on low-income workers, women, minorities, and everyone else has been carefully assessed.

An additional reason that Social Security benefits will likely be less adequate in the future without Congress legislating any changes is because of increasing Medicare premiums, which are generally directly deducted from Social Security benefits. At a time when today’s workers will likely be more dependent on Social Security, its benefits will, without legislation,replace smaller and smaller percentages of pre-retirement earnings.

Whether to Increase or Cut Social Security’s Modest Benefits is a Question of Values, Not Affordability

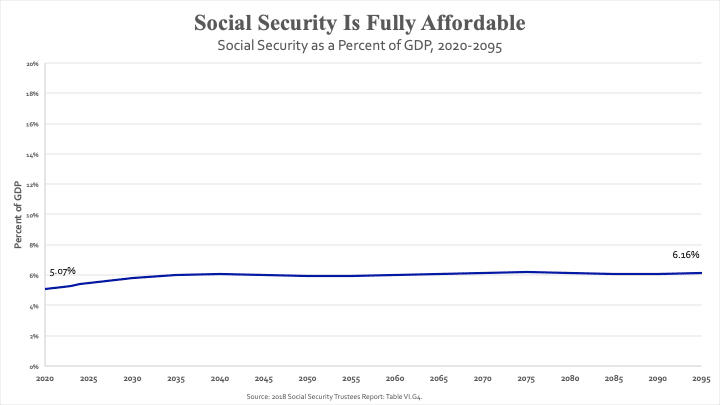

Social Security is extremely affordable. As the next chart makes clear, Social Security’s cost as a percentage of GDP is close to a straight horizontal line for the next three-quarters of a century and beyond.

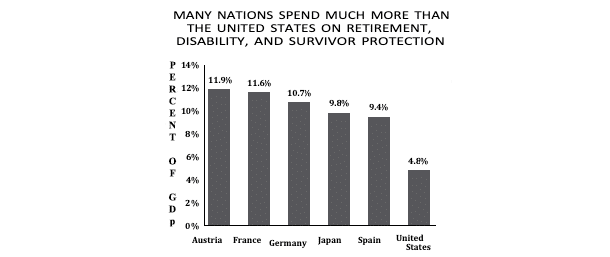

At the end of the 21st century, Social Security is calculated to cost 6.16 percent of GDP. That is a lower percentage of GDP than many other industrialized countries spend on their counterpart programs today:

Moreover, our nation is projected to be much wealthier at the end of the 21st century, just as we are wealthier now than we were seventy-five years ago, before computers, smartphones, and other technological advances. That means that the 5 to 6 percent of GDP will be easier to afford in the future, just as 10 percent is a larger amount, but more easily afforded, if you are earning $100,000 than if you are earning $10,000. In one case, you have$90,000 remaining; in the other, just $9,000.

Nor should the increase of just over one percent of GDP be difficult to absorb. To put that projected increase in perspective, military spending after the 9/11 terrorist attack increased by over one percent of GDP, as a result of the Iraq and Afghanistan wars—and that increase was the result of a surprise attack, with no advance warning. Similarly, spending on public education nationwide increased by 2.8 percentage points of GDP between 1950 and 1975, when the baby boom generation showed up as schoolchildren, without much advance warning.

Social Security is Insurance, Not Welfare: Means-Testing it Would Radically Change it

It is also imperative that Social Security be seen as the insurance that it is. Some treat it as if it were welfare and argue that it should not go to those who don’t “need” it. As part of the argument, they urge that Social Security be means-tested. That would fundamentally change what Social Security is.

It is unsurprising that some confuse Social Security and welfare because it is among the nation’s most effective anti-poverty programs,but that is a byproduct. Welfare programs are designed to alleviate poverty;Social Security and other insurance are designed to prevent beneficiaries from falling into poverty in the first place.

Social Security is part of workers’ compensation. It is a benefit that workers earn. Welfare requires recipients to demonstrate something negative about themselves: that they have so little income and assets that they are in need of the community’s help. In contrast, Social Security beneficiaries are asked to demonstrate something positive: that they have worked and contributed long enough to have earned their benefits.

Creating a means test, even if it were set at $1 million,would transform Social Security by requiring people to prove that they aren’t that wealthy. That would destroy the very essence of the program.

The nation already has means-tested welfare for seniors: the Supplemental Security Income program, financed from general revenue. SSI has eroded and should be increased, particularly by those proposing means-testing Social Security, if they are sincere about helping the most vulnerable among us. What should not happen, though, is the radical transformation of Social Security into a second SSI program,transforming it from insurance to welfare.

Benefits Should Remain Guaranteed, Not Subject to the Vagaries of the Stock Market

Similarly, some treat Social Security as if it were forced savings. They seek to convert its guaranteed benefits into a savings account. Everyone should save, if they possibly can. Everyone should also have adequate insurance. Savings are necessary for short-term emergencies and expenses; insurance is prudent for economic losses that are predictable for groups, but unpredictable for individuals, such as premature death, disability, or extreme longevity. Both insurance and savings are needed for economic security. Savings have their own strengths, but those strengths are not marks of their superiority to insurance. Savings are different from,but not superior to, Social Security or other insurance.

It is important to recognize that the higher rates of return that can be obtained through investment in equities could easily be obtained, on a collective basis, through Social Security, without affecting its basic structure of specified, guaranteed benefits, if that is what the American people favored.

Having Social Security diversify its portfolio is starkly different from individuals who invest retirement funds in the stock market. When individuals do so, they take a substantial risk. They bear the entire risk of poor investment performance. In addition, they have the risk of being forced to sell when the market is down. They ordinarily will have to cash in their investments at or near the time of retirement and, if they are to protect themselves from running out of money before they die, will need to purchase annuities, which makes the saver unable to recoup investment losses. In other words, individual investors have limited time horizons. Their retirements may not time well with the ups and downs of the stock market.

In contrast, a well-managed, diversified Social Security portfolio would never be in a position of having to reduce net assets at any particular time and so could ride the market’s ups and downs. Investment risks would be spread over the entire population and be independent of the time a worker filed for benefits. Retirement income would continue to be based on earnings records, not the vagaries of the stock market.

To repeat: Insurance, not savings, is what is needed to prepare for the possibility of substantial financial losses which are predictable for groups but unpredictable for individuals – like living to age 110, or becoming disabled, or dying prematurely, leaving dependent children. Social Security protects against all those risks.

To manage the risk of the financial loss associated with the loss of a home as the result of fire, homeowners purchase fire insurance; they do not simply save for the contingency. Similarly, car owners have car insurance, not car-accident savings accounts. And to manage the risk of lost income as the result of disability, death, or old age, wage insurance like that provided by Social Security is essential. To be economically secure, everyone who works for wages needs wage insurance in the form of Social Security and unemployment insurance.

Social Security Embodies the Best of American Values

Social Security has been so successful and popular because, from the beginning, it has embodied core American and religious values. It rewards hard work. The more workers earn and contribute, the higher their benefits. At the same time, in recognition that those who earn less have less discretionary income, it replaces a higher percentage of first dollars earned. It is prudently managed and responsibly financed. Social Security can only pay benefits if it has enough income to cover every penny of its cost, including the cost of administration. It cannot borrow or deficit-spend. As a result, Social Security does not add a penny to the government’s annual deficits or accumulated debt.

In a message to Congress proposing the expansion of Social Security, President Eisenhower captured the essence of the program:

“Retirement systems, by which individuals contribute to their own security according to their own respective abilities … are but a reflection of the American heritage of sturdy self-reliance which has made our country strong and kept it free; the self-reliance without which we would have had no Pilgrim Fathers, no hardship-defying pioneers, and no eagerness today to push to ever widening horizons in every aspect of our national life. The Social Security program furnishes, on a national scale, the opportunity for our citizens, through that same self-reliance, to build the foundation for their security.”

In working toward the important goal of improved retirement security for workers, it is crucial that Social Security be recognized as the essential program that it is. It is imperative that members of this Committee understand its basic structure, as well as the guiding principles and values that underlie that structure. That will guarantee that your actions will increase, not reduce the retirement security of the nation’s working families now and in the future.

Previous: Why Social Security works so well – and one way it doesn’t

Excerpted from testimony given by Nancy Altman, President of Social Security Works, at the February 6, 2019 hearing of the U.S. House Ways and Means Committee on improving retirement security for America’s workers.